QFC’s growing Assets under Management (AuM) showcase Qatar’s growth as a global financial centre.

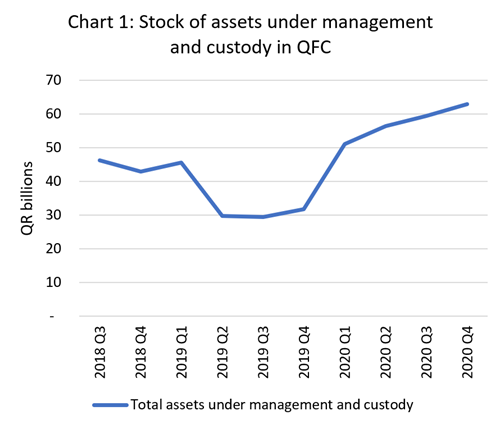

Total assets under management (AuM), and assets under custody, at QFC have shown significant growth recently reaching approximately QR 63.0 billion by Q4 2020.

Total assets under management (AuM) at Qatar Financial Centre (QFC) have seen a sharp increase recently. The AuM have more than doubled compared to Q4 2019, rising to QAR 61.2 billion by Q4 2020, whereas assets under custody rose to QR 1.8 billion, giving a total value of QR 63.0 billion. T¬¬he value of AuM in QFC complement QFC’s gross value added (GVA) contribution to Qatar’s GDP as a measure of QFC’s contribution to the Qatari economy. Whilst QFC’s GVA contribution of USD$ 1.89 billion in 2018 shows the substantial impact QFC has made on the Qatari economy in the recent past, the AuM show the contributions QFC may potentially make in the future. This is because the AuM are an indicator of future economic value through the activity they may generate. The AuM therefore provide an alternative view of QFC’s economic impact by showing QFC’s future economic potential.

AuMs can potentially help diversify the Qatari economy

There are a range of supporting economic benefits that may arise through the observed increase in AuM on QFC’s platform. In general, asset management can match investors seeking appropriate savings or investment vehicles and the financing needs of the real economy. Further, financial vehicles raise capital from retail and institutional investors and provide funding to other sectors, such as monetary financial institutions, non-financial corporations and government agencies.

Looking at QFC specifically, asset management can create benefits both directly, through the value added by expert management and planning of investments, and indirectly, through supporting services such as investment operations, accounting, advisory, legal, other professional services and other services. For example, Qatar Investment Authority (QIA) is already investing in Aventicum and is expected to work with more local investment managers. For instance, Maha Capital Partners (with QIA investment) with close to USD$ 300m is expected to be shortly announced, as well as asset classes like ESG Investment and Aviation Finance to discover Qatar. For example, data from surveys of asset management and investment services companies in QFC shows that nearly 70% of their overall supplier base comprised companies based in Qatar, demonstrating the indirect benefits QFC companies in the asset management sector are creating for local businesses.

Such activity can, in turn, can help boost economic diversification in Qatar by advancing the financial services industry and the broader sectors in the economy that support it – hence increasing the size and complexity of the local non-oil economy.

In the longer term, more AuM can bolster Qatar’s global reputation as a financial services hub, and lessons from other centres suggest this may require targeted policy interventions

The benefits set out above show the short-term economic potential of having a significant volume of assets under management in QFC – but the real prize may lie in the potential long-term benefits that can arise from establishing Qatar as a global financial services hub, to which AuM can be a key contributor.

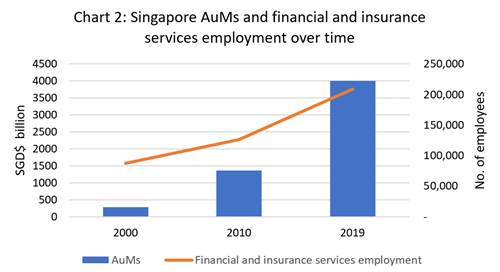

Singapore – ranked sixth in the Global Financial Centres Index (GFCI) in 2019 – provides an interesting case study. The country has seen impressive and consistent growth over recent decades, and AuM have played a key role in its success – in nominal terms, AuM increased from Singapore dollars (SGD)$ 276.2 billion (c. USD$ 203 billion) in 2000 to SGD$ 4 trillion (USD$ 2.9 trillion) in 2019.

The finance and insurance sector, acting as the main intermediary, now contributes over 14% of Singapore’s GDP and is the fourth largest economic sector in the country. Employment in this sector has also grown significantly over this period. The chart below shows that employment in this sector grew from 87,200 employees in 2000 to 209,400 employees by 2019, broadly trending with the growth in AuMs over this period. This does not include the additional jobs the sector is likely to have indirectly supported in other parts of the economy, but nonetheless provides a snapshot of the sustained economic benefits the sector has created over time.

Indeed, the broader Singaporean financial services sector journey can provide useful insights for Qatar. Firstly, the Singaporean government targeted, from an early stage, specific financial markets or sectors that were considered to be potential growth sectors – and then developed focused policies to grow those sectors. The asset management sector was one such sector – earmarked as a potential growth segment in the 1980s. Secondly, the Singapore government created the infrastructure and incentives to give opportunity for the asset management sector to grow. This included government co-investments; tailored regulations targeting experienced fund managers; tax incentives for local fund managers; internationalization of the Singapore Dollar; and the establishment of a Singapore Dollar Bond market. This sectoral targeting, also referred to as “niche creation,” has also played a key role in developing some of Singapore’s other key sectors (such as offshore banking and foreign exchange, amongst others).

Other comparators have similarly developed their financial services industry through targeted measures. For instance, Dubai, home to the Dubai International Financial Centre (DIFC), was ranked 12th in the world in last year’s GFCI. Total AuM by 2019 was USD$ 99 billion , and the finance and insurance sector contributed 10% of Dubai’s GDP in 2019. DIFC’s status as a global financial cenrer is strongly underpinned by its significant volume of AuM, and in turn this makes a significant contribution to the economy. A significant portion of DIFC’s success can likely be attributed to the introduction of policies that helped create an investor-friendly environment, such as 100% foreign ownership and a zero tax rate on income and profits. However, there have also been more targeted policy interventions to boost the centre. Soon after the DIFC’s inception, the financial regulator granted licenses to major asset management companies, giving investors access to new asset classes in the region, such as global trade finance-related assets. In 2013, DIFC reached an agreement with the European Securities and Market Authority that ensured companies in DIFC were allowed to market alternative investment vehicles such as private equity and hedge funds to European investors. This year DIFC was host to the first major globally compliant digital securities offering in the region. Similar to the Singapore story, a key lesson here is that while having the right infrastructure in place for the financial services sector is a prerequisite for success, targeted initiatives to give the sector a boost are also critical – as this can potentially lay the roots for more organic growth in the future. And, indeed, QFC has developed important incentives in this regard. For instance, QFC developed a tax incentive (0%) for asset managers with AuM of at least USD 30 million and a small team (three full-time employees) in Qatar.

Clearly, QFC is making a strong contribution to the economy, as demonstrated by a contribution of 1.5% to Qatar’s non-oil GDP in 2018. To build on this success and ensure sustainability, QFC may benefit from global practices where targeted policy interventions were applied to create the right environment and infrastructure for the financial services industry to thrive. This can bring real economic rewards through the financial services and supporting industries and bring about sustainable economic diversification.

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text