Renewed expansions in activity and demand in January

Doha, Qatar: 5 February 2024 – Qatar's non-energy private sector registered improving business conditions in the opening month of 2024, according to the latest Purchasing Managers’ Index™ (PMI®) survey data from Qatar Financial Centre (QFC). Volumes of output, new business and backlogs of work were all higher compared with December levels, while employment growth was maintained, and the 12-month business outlook strengthened. Meanwhile all four price indicators registered declines and supply chains continued to improve. Financial services showed signs of cooling with stable levels of both activity and new work.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline Qatar Financial Centre PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

The PMI registered 50.4 in January, up from 49.8 in December. The latest figure was above the no-change mark of 50.0 and thereby signalled improving business conditions in the non-energy private sector economy.

Of the five components of the headline figure, output, new orders and employment all registered above 50.0 index readings in January, indicative of month-on-month expansions. These were partly offset by shorter suppliers' delivery times and a reduction in input stocks at non-energy private sector firms.

Demand conditions in Qatar's non-energy economy grew in the first month of 2024, building on solid growth on average across 2023. Firms that reported greater sales cited new customers, promotional campaigns, competitive pricing and tourism related to the AFC Asian Cup. The renewed rise in demand contributed to a brighter 12-month outlook than at the end of 2023.

Improving inflows of new work translated into a renewed rise in total activity in January. The rate of growth was not as strong as that seen on average throughout 2023, however, which partly explained a rise in outstanding business during the month. Backlogs of work have risen twice in the past three months, highlighting some pressure on operating capacity.

Qatari firms continued to raise employment, extending the current sequence of growth to 11 months. Purchases of inputs fell for the first time over the same period, however, as firms reported sufficient inventory levels. Input stocks fell the most since November 2022. This further alleviated pressure on supply chains, as lead times shortened for the twenty-first successive month.

Average input prices fell in January, driven by both wages and purchase costs. Output prices fell for the third straight month, and the most since last June.

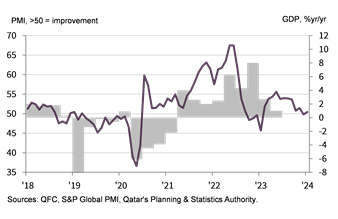

QFC Qatar PMI vs. GDP

Financial services sector broadly stable in January

- Stable volumes of activity and new business at start of 2024

- Financial services employment continues to increase

- Charges for financial services fall for first time in four months

Qatari financial services companies recorded broadly stable volumes of total business activity and new contracts in January. The seasonally adjusted Financial Services Business Activity and New Business Indexes posted 50.1 and 50.2 respectively, signalling broadly no change since December. Companies remained optimistic on the 12-month outlook for activity.

Meanwhile, employment at financial services firms rose for the tenth month running, albeit at a slower rate.

In terms of prices, average charges set by financial services companies fell for the first time in four months, while cost inflation in the sector eased further.

The first batch of PMI data for 2024 signalled improving business conditions for Qatari non-energy firms, following a solid economic expansion in 2023.

There were renewed expansions in output and new orders in January, following brief pauses at the end of 2023. Moreover, demand was strong enough to generate an increase in outstanding business, only the second occurrence of rising backlogs over the past year-and-a-half.

The latest data also signalled waning price pressures, with all four price indicators – overall input prices, staff costs, purchase prices and output prices – posting below the neutral 50.0 level.

Another positive fact from the latest survey was a strengthening in companies' expectations for the next 12 months.

Yousuf Mohamed Al-Jaida

Chief Executive Officer, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text