Non-oil private sector output growth continues in September

Doha, Qatar: 5 October 2022 – The latest Purchasing Managers’ Index™ (PMI™) survey data from Qatar Financial Centre (QFC) continued to indicate growth in the non-oil private sector at the end of the third quarter. The rate of expansion in total activity gained momentum with output rising markedly in September. New orders fell for the first time in 27 months, however, while back-to-back contractions were seen in employment and inventories. Nevertheless, the fast-approaching FIFA World Cup supported optimism with sentiment improving to a 12-month high.

On the price front, a fall in purchase costs contrasted with higher wage expenses, leading to only a marginal increase in overall input prices. Meanwhile, firms sought to boost profits by hiking their selling prices at a near-record rate.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline Qatar Financial Centre PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

At 50.7 in September, down from 53.7 in August the latest PMI pointed to a softer improvement in business conditions in Qatar's non-energy sector.

Central to the moderation was a renewed decline in new orders. The fall was broad-based with all monitored sectors registering lower sales, led by construction. Panel comments indicated that client projects were placed on hold due to the upcoming World Cup.

Despite weaker demand, firms sought to boost their output in September. Business activity increased for the twenty-seventh month running with the latest uptick marked. Moreover, the rate of output growth was quicker than the long-run series average amid expectations of greater activity in the coming months.

Firms continued purchasing inputs at the end of the quarter, albeit at a softer pace. Inventory holdings meanwhile fell fractionally.

Overall input price inflation rose only marginally, and at a pace that was below than the long-run series average. Despite this, firms hiked their selling prices at the second-quickest rate in the survey’s history with comments indicating a greater emphasis on their profit margins.

Headcounts were also cut amid cost saving efforts, but a fall in backlogs suggested spare capacity persisted in the non-oil economy.

Vendor performance improved in September with lead times now shortening in each of the last five months.

Looking ahead, the FIFA World Cup continued to underpin optimism with firms hopeful that greater tourist activity in the coming months would support output growth. In fact, sentiment improved the highest for a year.

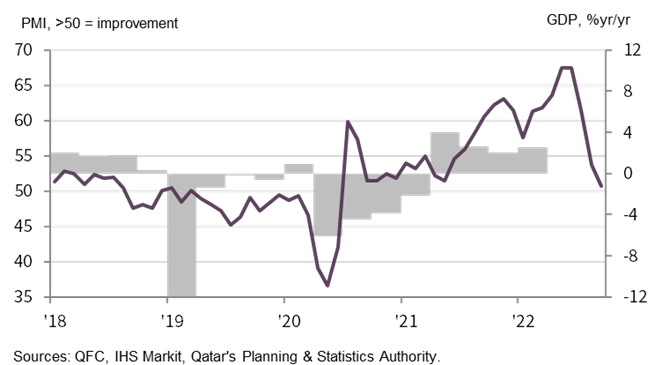

QFC Qatar PMI™ vs. GDP

Strong business growth continues in Qatar's financial sector

- Activity and new orders expand for the fifteenth month in a row

- Back-to-back decline in headcounts

- Firms remain upbeat about growth expectations

The latest PMI data on Qatar's financial services sector signalled further marked improvement during September. Business activity increased sharply, but the rate of growth eased slightly from August. New orders, meanwhile, rose only slightly, and at the softest pace for 15 months.

At the same time, Qatari financial service firms cut their headcounts for the second month in a row, but the rate of decline was only mild.

On the price front, overall input prices fell, albeit only fractionally. Meanwhile, selling prices rose only slightly.

Businesses remained optimistic of activity growth in the year-ahead with sentiment firmly in positive territory, despite easing notably from that seen in August.

Qatar's non-oil economy continued to grow in September, rounding off another solid quarterly performance. There were, however, divergences in latest data with a sharp and substantial increase in output contrasting with a renewed fall in demand. Anecdotal evidence suggested clients were placing orders on hold in preparation of the World Cup while Qatari businesses were at the same time increasing output in anticipation of greater demand.

"With demand retreating, firms cut their headcounts in September. Panel comments suggested that Qatari firms were placing more emphasis on their profit margins which was further highlighted in prices data where despite a marginal uptick in overall input costs, firms hiked their selling charges at the second-quickest rate in the survey's history. This will serve firms well as demand temporarily falters

Yousuf Mohamed Al-Jaida

Chief Executive Officer, QFC Authority

Contrast View

Contrast View

Increase Text

Increase Text

Decrease Text

Decrease Text

Reset Text

Reset Text